travel nurse salary taxes

Travel Nursing Tax Deduction 2. As mentioned above we simply subtract the estimated weekly taxes from the weekly taxable wage and add the remainder to the total weekly tax-free stipends to calculate weekly net pay for a contract.

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

Chapter 2 Are You Meant to Be a Travel Nurse.

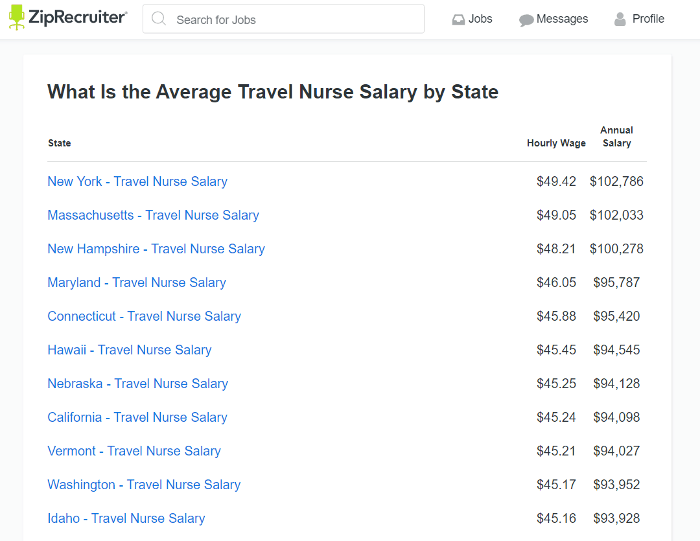

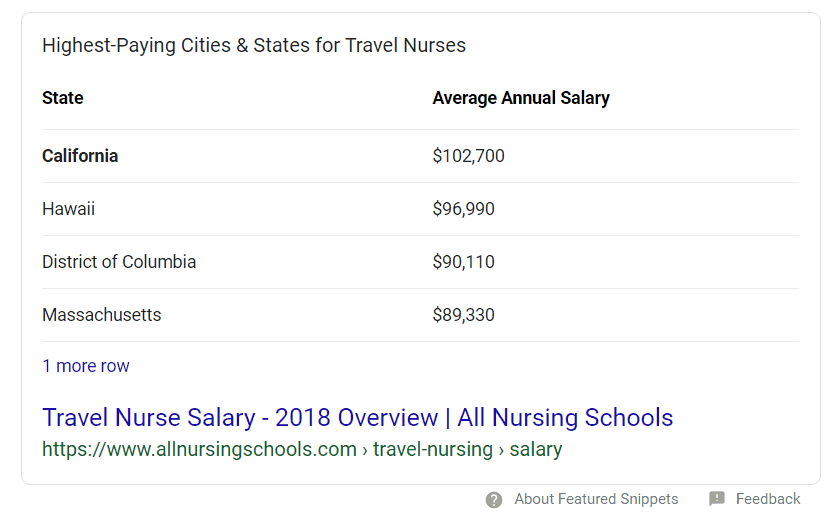

. Bureau of Labor and Statistics BLS travel nurses earn just over 51 an hour on average while RNs earn just under 3850 an hour. Your hourly wages are taxable but these per diems are not. Travel nurse earnings can have a tax advantage.

Rep your home state. Others can read this sites handy advice. The monthly salary for travel nurses averages out to 9790 and may vary depending on.

Taxable and non-taxable income tax home and if the states they traveled in had an income tax are all variables that need to be considered. 2021 has been a unique year for travel nurses and some pay packages were different. Travel nurse taxes work a lot differently than a staff nurses taxes.

Chapter 1 A Saga of How It Started. According to Vivian a healthcare jobs marketplace and the US. 250 per week for meals and incidentals non-taxable.

One of the many incentives medical companies may use to entice traveling nurses is through the use of per diems wages paid for daily living expenses such as food gas or other basic expenses. These reimbursements or stipends can be tax free with proof of an official tax home in your home state and duplication of expenses. Average RN Salary.

Have a permanent physical residence that you pay for and maintain. You will also need to pay estimated taxes since there are no tax withholdings for independent contractors. Chapter 6 Finding Your.

When doing proactive planning Willmann says its important to pay attention to your marginal tax rate. Your listed bill rate typically takes all of this into account. Chapter 5 Travel Nursing Assignments.

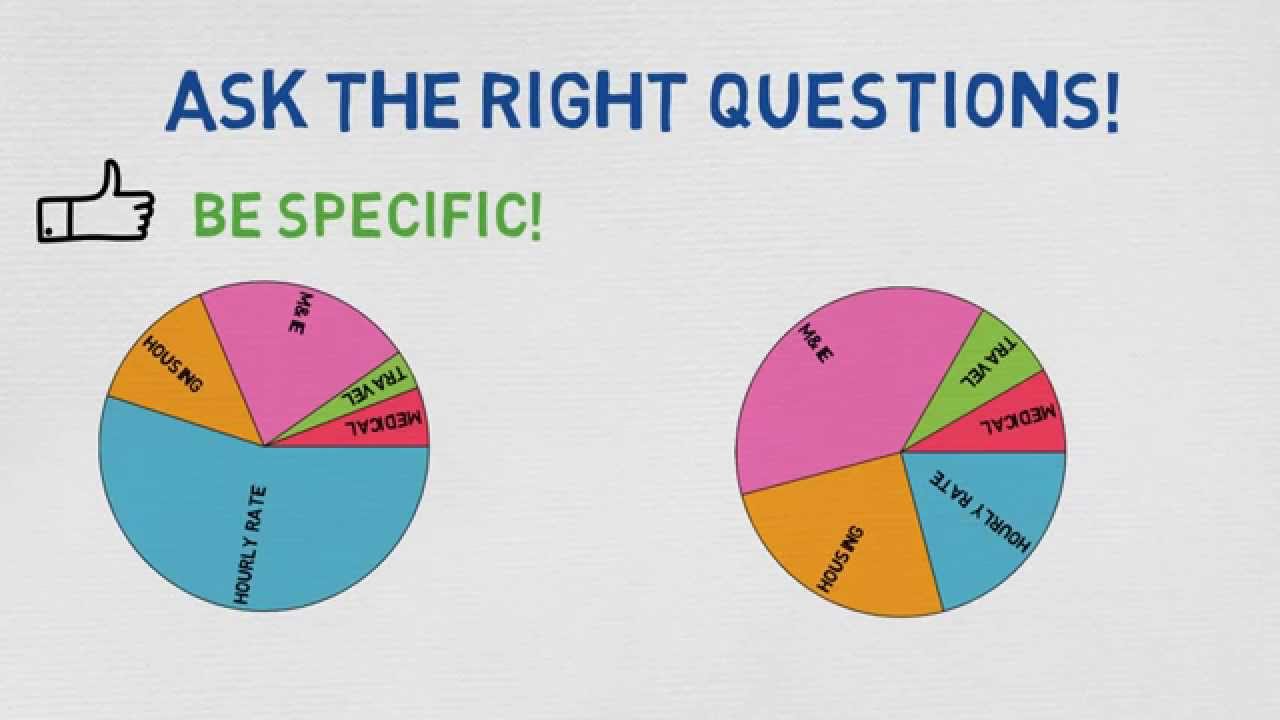

Save a record of this through photos flight records etc. Tax homes tax-free stipends hourly wages bonuses benefits housing and per diem reimbursement are all factors to consider when understanding your travel nursing pay and taxes. Joseph Smith EAMS Tax an international taxation master and founder of Travel Tax explains that in addition to their base pay most travel nurses can reasonably expect to see 20-30000 of non-tax reimbursement payments in a typical year of work as a travel nurse.

Dont forget to visit your primary residence at least once every 12 months. This is because companies can legally reimburse its nurses for certain expenses incurred while working away from home you can think of these as travel expenses. Utilizing a tax free stipend is incredibly important within travel nursing taxes.

24 for taxable income between 85526 and 163300. 22 for taxable income between 40126 and 85525. The 50 Mile Rule is one of the most common fallacies pertaining to tax-free reimbursements for travel nurses.

Its also worth really familiarizing yourself with the tax implications of working in a different state as the wage component of the total compensation package will translate differently as take-home pay from one state to the next. When April rolls around you know it is tax season. Travel Nursing Pay The 50 Mile Myth for Tax Free Stipends.

Chapter 3 Travel Nurse Schooling. Keep in mind the travel nurse rate will be taxed only on the hourly based rate. Im only going to address the issue of tax-free stipends aka per diems the IRS kind not the nurse shift kind for nurses who maintain and pay for another residence while temporarily on travel assignment.

As a travel nurse working outside of your tax home you are eligible for tax-free stipends in addition to the hourly wages you earn. Estimated taxes or quarterly taxes should be 25 of the tax you expect to owe for the year. To claim the tax benefits of being a travel nurse your tax home must fit these requirements.

Here is an example of a typical pay package. As mentioned above 1099 travel nurses have to pay the 153 SE tax rather than ½ of FICA for W2 employees. The History of Travel Nursing.

For an assignment to be considered temporary it must be expected to last less than one year. Resources on tax rules for travelers and some key points. Mar 03 2021.

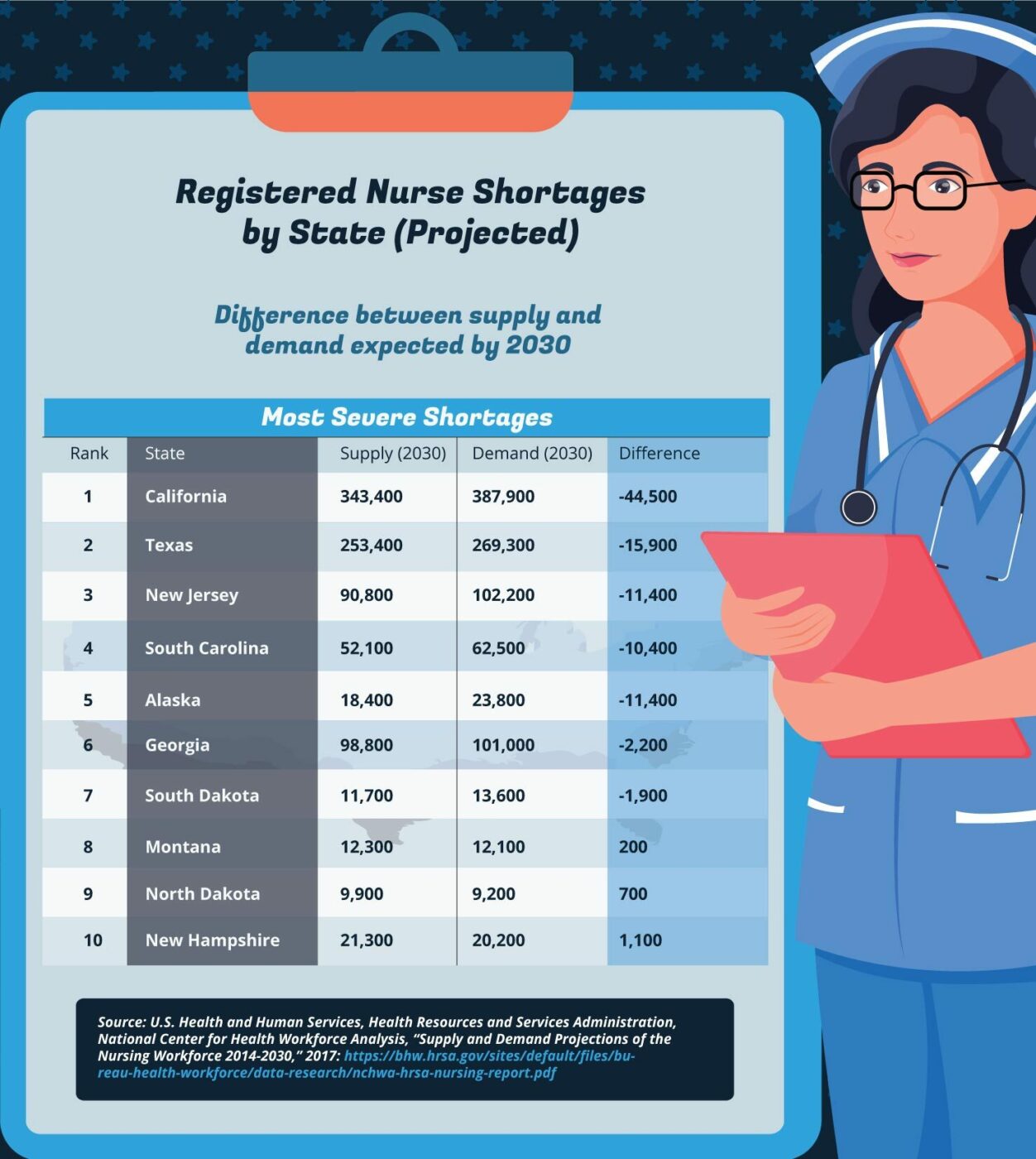

1099 employees expecting to owe over 1000 in taxes have to file and pay taxes quarterly whereas W2 employees have taxes withheld every pay period but only have to file annually. Deciphering the travel nursing pay structure can be complicated. You must have regular employment in the area.

Travel nurse taxes are due on April 15th just like other individual income tax returns. Specifically in California Tax-Free Stipends can be as much as 1800 per week for housing in San Francisco and 500 per week for Meals and Incidentals MIE. Thats the tax rate on one more dollar of income he says.

Spend at least 30 days of the year in that place. Chapter 4 Dough Pesos Loot The Almighty Dollar. A 65 per hour pay rate works out to closer to 20 per hour of taxable income with the rest representing the non-taxable aspect.

A blended rate combines an hourly taxable wage such as 20 an hour with your non-taxable reimbursements and stipends to give you a higher hourly rate. Its prominent among both travel nurses and travel nursing recruiters. Travel Nurse Tax Deduction 3.

Find a Job Land a Job and Keep a Job. Purveyors of this rule claim that it allows travel nurses to accept tax-free. For Sample 1 were looking at 720 16759 55241 68846 124087 net weekly pay.

These practitioners can earn 1840-6340 per week averaging a 36-hour work week. Travel Nursing Pros and Cons. 20 per hour taxable base rate that is reported to the IRS.

As you interview for and are offered travel nursing jobs pay close. Average Travel RN Salary. Be registered to vote in your primary living area and have a drivers license in that state.

How Much Do Travel Nurses Make Nursejournal Org

How Much Do Travel Nurses Make Factors That Stack On The Cash

Travel Nurse Salary Comparably

Travel Nurse Tax Deductions What You Need To Know For 2018

Everything About Travel Nursing Taxes And Tax Free Money Bluepipes Blog

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

Travel Nurse Taxes All You Need To Know Origin Travel Nurses

How Do Taxes Work For A 1099 Travel Nurse Clipboard Academy

Travel Nurse Tax Deductions What You Need To Know Mas Medical Staffing

What Is Travel Nursing Academia Labs

Travel Nurse Pay Breakdown Expenses Tax 2022 Travel Nursing

Travel Nurse Pay Package Complete Guide With Examples

How To Make The Most Money As A Travel Nurse

Complete List Of Average Nursing And Travel Nursing Salaries By State By Nomad Health Nomad Health Medium

5 Warning Signs That A Travel Nursing Pay Package Is Too Good To Be True

How Much Do Travel Nurses Make The Definitive Guide For 2020 Bluepipes Blog

How To File Your Taxes As A Travel Nurse Ioogo

Travel Nurse Taxes How To Get The Highest Return Next Move Inc